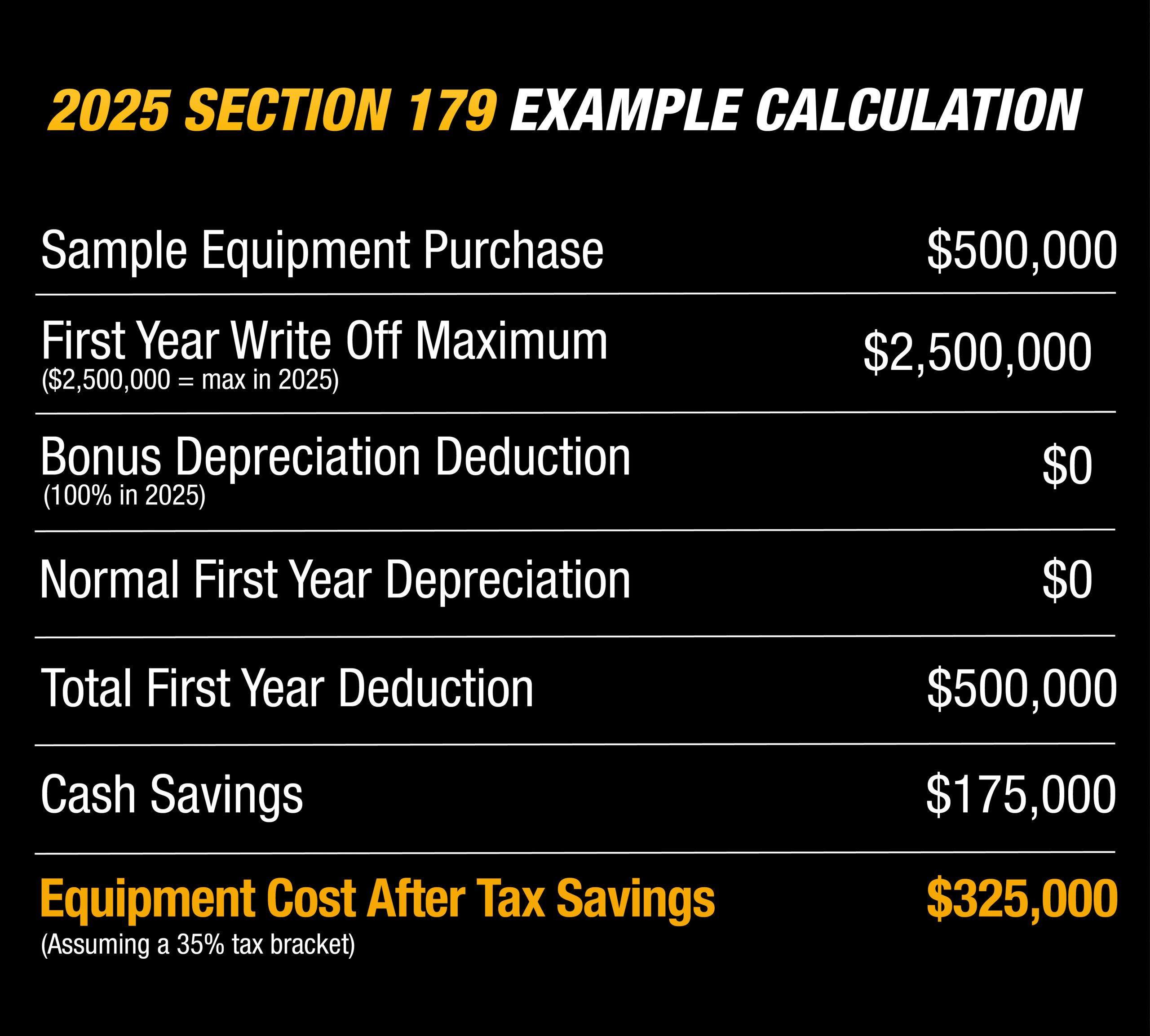

Take advantage of the Section 179 Deduction this year, purchase the equipment you need to optimize your work for next year, and save big!

What is Section 179?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means if you buy a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Section 179 At a Glance

$2,500,000

2025 Deduction Limit

New and used equipment purchases qualify for the deduction. Qualified financing is also available for Section 179.

$4,000,000

2025 Spending Cap on Equipment Purchases

Once this amount of spend is reached, the deduction available is reduced. Bonus depreciation is an option for companies that spend more than this limit.

100%

2025 Bonus Depreciation

Bonus Depreciation is an option for companies that have spent over the cap. It is available for both new and used equipment.

The Section 179 deduction has exceptions. Not all equipment purchases qualify. To take the deduction for the current tax year, the equipment must be paid for in full, physically delivered, and put into service between January 1 and the end of the day on December 31 of this year to meet federal guidelines. This information should not be considered as tax or legal advice. Consult with a qualified tax professional concerning your specific situation and how you may benefit from this program.